If you care about your money, then this article is for you! There are many apps and websites that can help you budget, invest, and save your money. You no longer have to keep everything in your mind and write it down in an old notebook.

Keep this in mind, here are seven of the best free tools for making the most of your money.

1. Google Sheets

Google Sheets is a powerful spreadsheet application. Sheets is how I keep track of my investments and net worth. Sheets make it simple to track expenditures, and there are several free budget templates available.

Google Finance features an easy-to-use interface for importing data on stocks, ETFs, and mutual funds. You can monitor the price, name, and even expense ratio of most exchange-traded funds and mutual funds.

The spreadsheet keeps track of the values of stocks, ETFs, and mutual funds. Additionally, it keeps track of my asset allocation and alerts me when to rebalance.

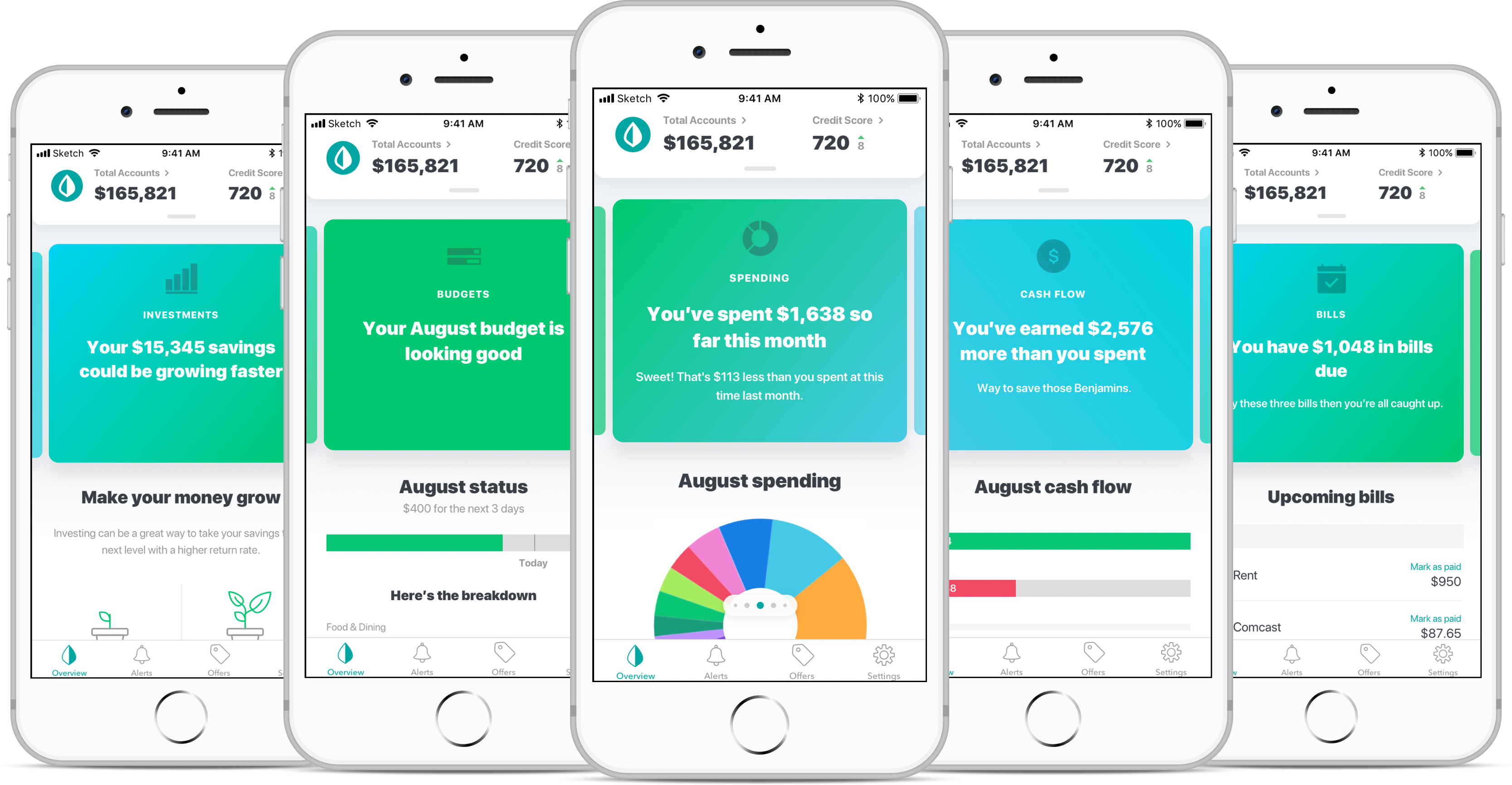

2. Personal Capital

Personal Capital is perhaps the most excellent overall money app. This free app helps you keep track of your spending, income, bank accounts, credit cards, house worth, cryptocurrency, and taxable and retirement investment accounts. Its most advantageous characteristics are around investment.

Personal Capital provides a plethora of information about your portfolio when connecting your retirement and investing accounts. You may analyze your asset allocation, investment expenses, and progress toward retirement. Its Fee Analyzer calculates the weighted average cost of your assets and the impact these expenses will have over time on your wealth. Additionally, its Investment Analyzer analyzes your portfolio and gives investment suggestions depending on your risk tolerance.

Personal Capital may also track the dividends and interest earned on your investments. It keeps track of bills as they come due. Additionally, it includes a savings planner to assist you in meeting your savings objectives. Along with a website, Personal Capital provides smartphone and tablet apps.

3. Mint

Mint was one of the first online budgeting applications. As with Personal Capital, customers may connect their accounts to Mint to manage anything from budgeting to investing. Mint also includes monitors for bills and subscriptions, as well as tools for monitoring your credit.

Whereas Personal Capital is geared at investors, Mint is geared toward budgeting. You may set savings goals, create cost categories, and keep track of your payments. Mint generates income through advertising, which means you may expect to see tailored offers for credit cards, bank accounts, and other financial goods.

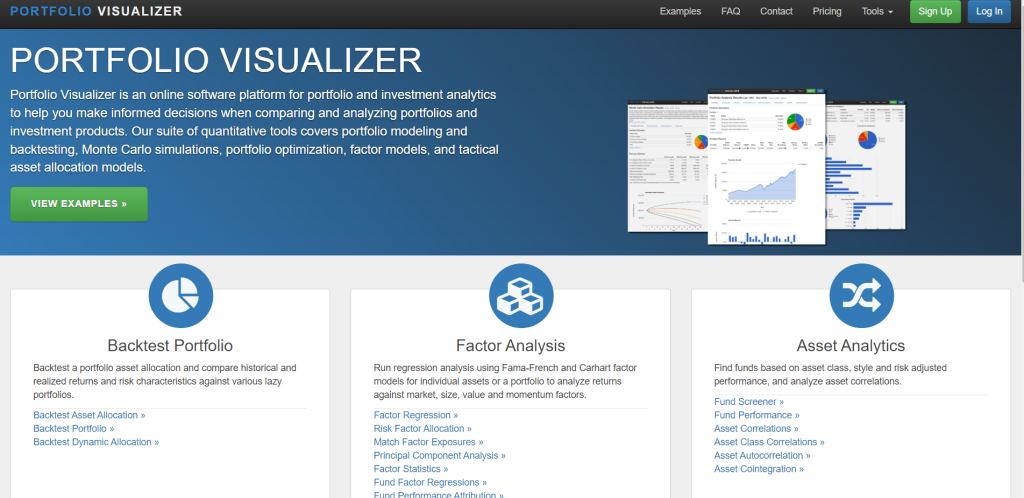

4. Portfolio Visualizer

Portfolio Visualizer is not intended to be used as a budgeting tool. Rather than that, it provides users with tools for evaluating their investments. Portfolio Visualize gives statistics on performance and risk, among other things, when you enter your investments. Additionally, you may compare your portfolio to other low-maintenance portfolios, such as the 3-Fund Portfolio.

Additionally, the tool has a slew of extra capabilities. You may simulate a portfolio using Monte Carlo simulations. It enables you to affect lump sum investments, recurring payments, and withdrawals, making it handy regardless of your level of investing. Additionally, it provides factor analysis, portfolio optimization, and forecasting models (e.g., momentum).

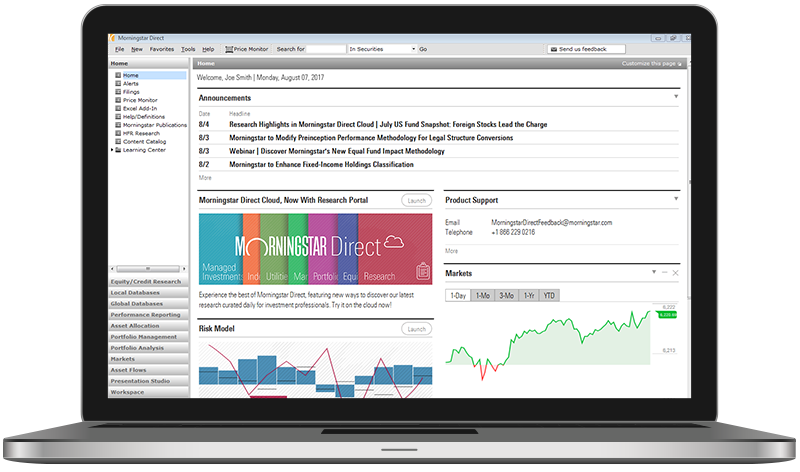

5. Morningstar

Morningstar is another reputable fund manager. While it requires a fee, you may track your portfolio for free (minus some premium features like X-Ray). The disadvantage is that users must enter and manage their portfolios manually. On the plus side, Morningstar provides individual investors with some of the most robust data, ETFs, and mutual funds accessible.

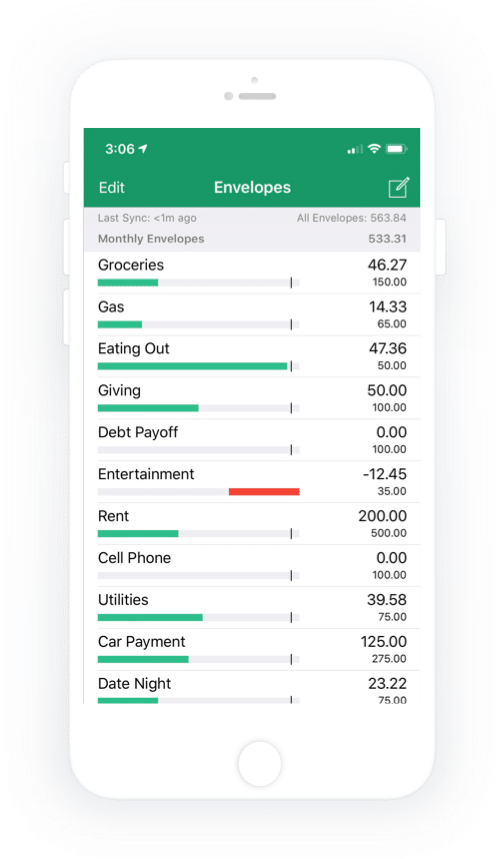

6. Goodbudget

Goodbudget is a budgeting application that is based on the envelope concept. Goodbudget, available in both a free and premium edition, has features for managing debt and setting savings goals. The software is compatible with mobile devices, allowing users to sync and manage their finances across many platforms.

Additionally, Goodbudget offers a Bootcamp for people new to budgeting and money management. The Bootcamp covers everything from emergency fund savings to budgeting as a pair to property ownership.

7. Trim

Finally, Trim assists customers in making financial savings. Trim analyzes your expenditure once you link accounts to discover areas where you may save money. Trim will bargain on your behalf in order to lower your monthly spending on anything from your phone bill to medical bills after your consent. Additionally, it detects any lapsed subscriptions that you may choose to cancel.

Creating an account is completely free. Trim charges a fee equivalent to 15% of the amount saved during the first year if you authorize Trim to bargain on your behalf, and Trim saves you money. Trim claims that its consumers save an average of $620.

Final Remarks

The sheer volume of new financial instruments vying for our time and money may be intimidating. Fortunately, the programs listed above are all free (though some may have commercial versions) and cover virtually every facet of our financial lives. Personal Capital, in our opinion, is the most versatile, although all of them provide valuable tools that can assist you in managing your money.