If you are interested in buying stocks, then you know that the price of a stock depends on the performance of the company, its value correlates both with the success of the company and with the number of issued shares. Due to the second factor, stocks of a large and successful company may have a lower price.

There is something attractive about collecting cheaper stocks. First, it is easier to buy a lot with a round number if it does not bring big losses. Second, there is evidence that such stocks tend to perform better than their more expensive counterparts.

So, check out these great under $ 10 stocks worth adding to your portfolio!

The S&P 500 is poised to reach new all-time highs in 2022, having more than doubled from its March 2020 lows. Quality stocks trading for less than $10 per share are few and far between at the moment. Stocks priced at that level might serve as a warning sign to investors that something is gravely wrong with a business. Numerous of these bargain-priced stocks have questionable business strategies or bleak near-term outlooks. However, the CFRA Research analyst team has discovered eight inexpensive, high-quality companies that may provide exceptional value for thrifty investors. According to CFRA, there are eight stocks under $10 to purchase in December.

The best under-ten-dollar stocks to buy:

- New Oriental Education & Technology Group Inc. (EDU)

- Kinross Gold Corp. (KGC)

- Oatly Group AB (OTLY)

- Pitney Bowes Inc. (PBI)

- TAL Education Group (TAL)

- Telefonica SA (TEF)

- Telecom Italia SPA (TIIAY)

- Tencent Music Entertainment Group (TME)

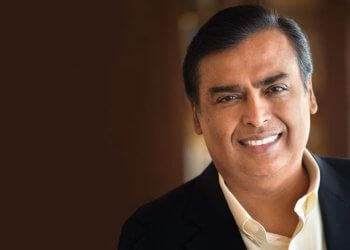

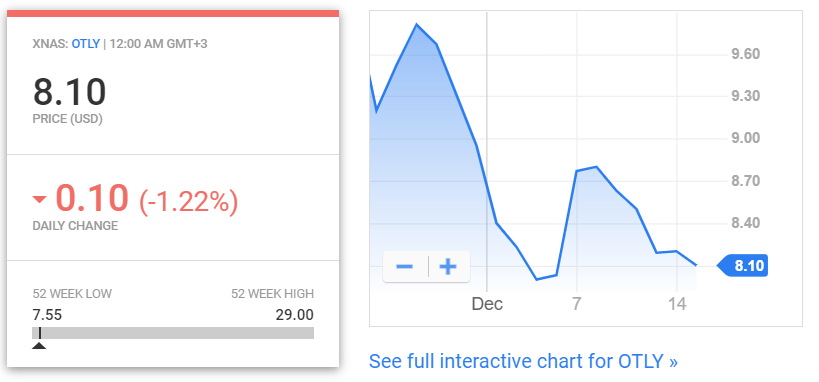

1. New Oriental Education & Technology Group Inc. (EDU)

New Oriental Education & Technology Co., Ltd. is one of China’s leading education conglomerates. The stock has plummeted in value in 2021, falling from 52-week highs of over $20 to less than $3 following the Chinese government’s announcement of a crackdown on for-profit after-school tutoring businesses. While the regulatory picture for New Oriental remains uncertain in the near term, analyst Aaron Ho believes the current sell-off is a chance for long-term investors to purchase. Ho asserts that New Oriental has the financial resources and technology capabilities necessary to alter its offerings for regulatory compliance and profitability. CFRA rates EDU stock as a “buy” with a $5 price objective, up from $2.20 on Dec. 13.

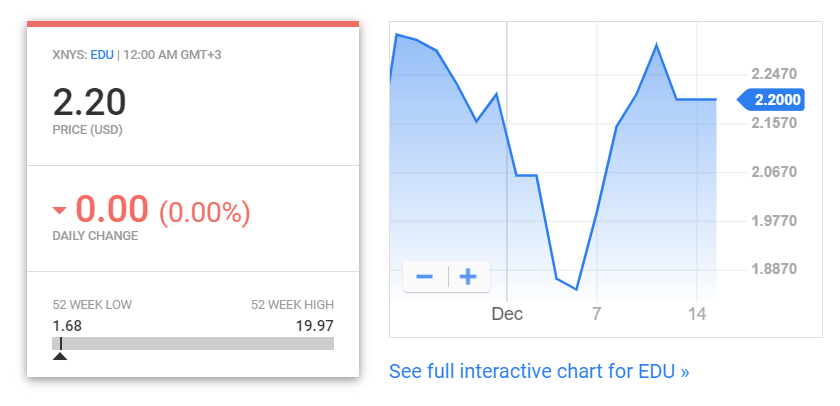

2. Kinross Gold Corp. (KGC)

Kinross Gold recently fell more than 10% on the announcement of a $1.42 billion takeover of Great Bear Resources Ltd. Kinross, according to analyst Matthew Miller, has many growth initiatives and an appealing value. On the majority of fundamental valuation indicators, including the price-earnings ratio and enterprise multiple, the company is now trading at a significant discount to rivals. Miller expects Kinross’ free cash flow to more than double from $250 million in 2021 to about $1.2 billion in 2022 and believes the stock will outperform as gold prices climb. CFRA rates KGC stock as a “strong-buy” with a $9.38 price objective, up from $5.20 on Dec. 13.

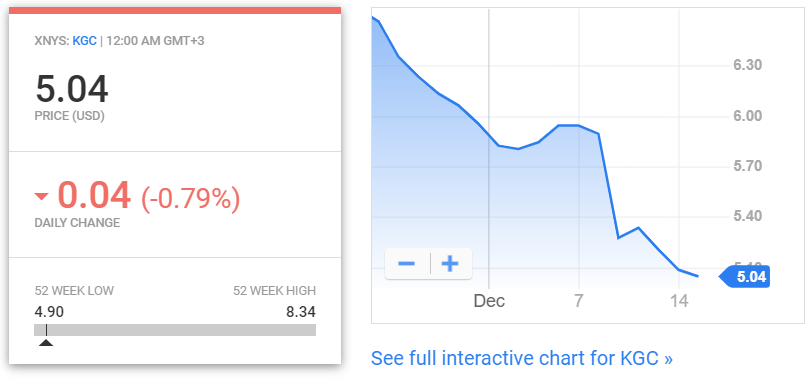

3. Oatly Group AB (OTLY)

Oatly is the world’s largest manufacturer of oat milk. With the company trading below $9, analyst Arun Sundaram believes Oatly’s pricing is “too appealing to refuse.” Sundaram anticipates a 33 percent compound annual revenue growth rate for Oatly over the next decade, compared to a 26 percent compound annual revenue growth rate for Beyond Meat Inc. (BYND). However, Oatly trades at a substantially lower enterprise value-to-sales multiple than Beyond Meat at the moment. Finally, Sundaram asserts that Oatly’s near-term capacity and production constraints are transitory. CFRA rates OTLY stock as a “buy” with a $15 price objective, up from $8.19 on Dec. 13.

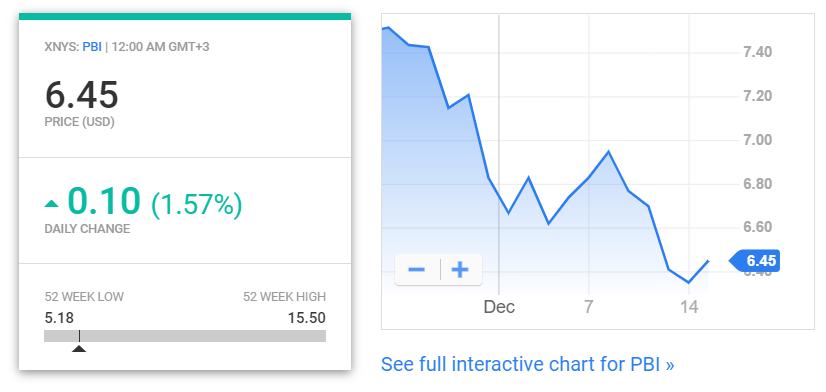

4. Pitney Bowes Inc. (PBI)

Pitney Bowes is a mailroom automation specialist and provider of other facilities management services. According to analyst John Freeman, Pitney’s strong third-quarter earnings report, which included revenue growth of 11% year over year, indicates the company has reached a tipping point in its efforts to help businesses bridge the divide between software-based ecosystems and physical goods shipping services. CFRA forecasts a 44.7 percent increase in profits per share in 2022. According to Freeman, Pitney Bowes offers tremendous price upside, but the company is best suited to investors with a higher tolerance for risk. CFRA rates PBI stock as a “strong-buy” with a $14 price objective, up from $6.41 on Dec. 13.

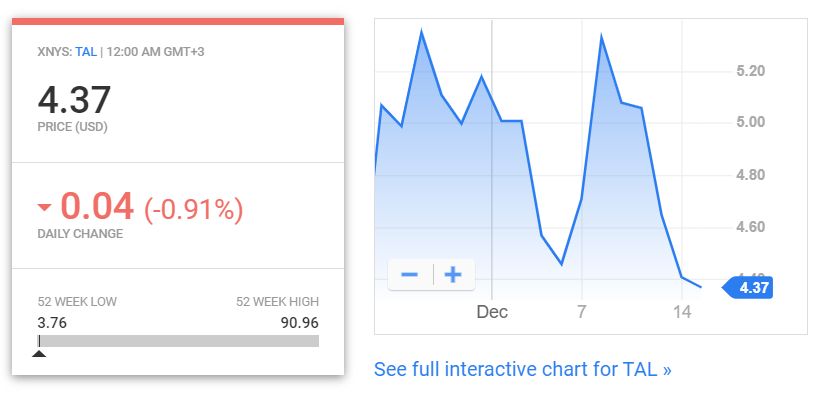

5. TAL Education Group (TAL)

TAL Education is another Chinese education company that has suffered from a governmental crackdown. Although the stock is down more than 90% in 2021, Ho believes TAL’s financial strength should enable it to adjust to changing regulatory environments while being profitable. Despite supply constraints imposed by the government, Ho anticipates continued strong demand for after-school tutoring services. Ho anticipates the strict implementation of the new limits by the government but believes sector leaders will eventually weather the storm. He expects that TAL’s revenue growth will return in fiscal 2023. CFRA rates TAL stock as a “buy” with a $10 price objective, up from $4.65 on Dec. 13.

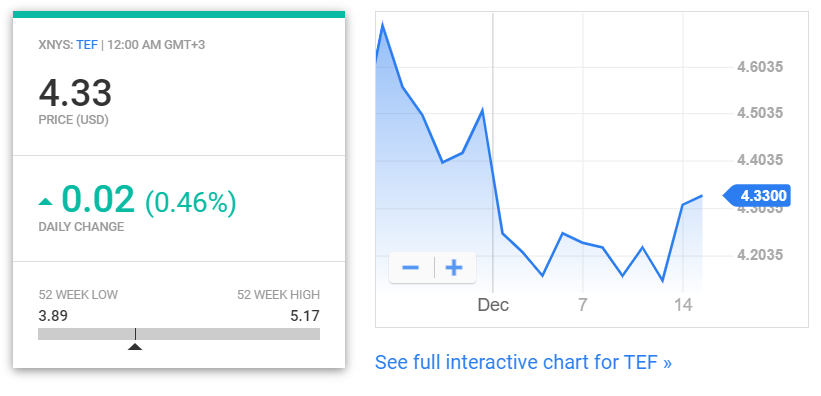

6. Telecom Italia SPA (TIIAY)

Telefonica is Spain’s largest telecommunications business. According to analyst Adrian Ng, Telefonica has made numerous positive financial moves, including debt reduction, the acquisition of E-Plus in Germany and GVT Holdings in Brazil, and abandoning the Central American market. Telefonica purchased 700 megahertz of wireless spectrum in Spain in the third quarter and expanded its 5G network in Germany to more than 100 towns. According to Ng, these moves should help the company unlock value as it refocuses on more stable areas. Telefonica also pays a hefty dividend of 10.6 percent. TEF stock, which closed at $4.15 on Dec. 13, has a “buy” rating and a $5.50 price target from CFRA.

7. SPA Telecom Italia (TIIAY)

Telecom Italia is Italy’s largest fixed-line and cellular telecommunications company, with operations in Brazil as well. According to Ng, the company’s “Beyond Connectivity” project, which will run until 2023, intends to move Telecom Italia’s focus away from operational stability and toward development. The effort is focused on creating equity-free cash flow, lowering debt, and distributing 20% to 25% of equity-free cash flow to shareholders through dividend payments. According to Ng, KKR & Co. Inc. (KKR), a private equity group based in the United States, may also increase its previous $12 billion takeover proposal for Telecom Italia. CFRA rates TIIA.Y stock as a “buy” with a $5.70 price objective, up from $5.04 on Dec. 13.

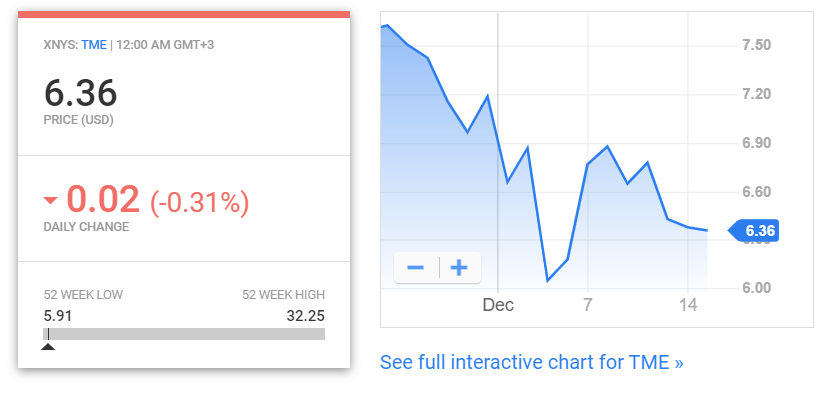

8. Tencent Music Entertainment Group (TME)

Tencent Music is China’s largest online music platform, owning QQ Music, Kugou Music, and WeSing. Tencent Music shares are expected to fall by more than 65 percent in 2021 as Chinese regulators tighten limits on technology stocks, and US regulators threaten to delist Chinese companies that do not comply with new auditing criteria. According to analyst Ahmad Halim, advertising income should help Tencent Music grow its margins over time, and the stock’s decline has presented an excellent purchasing opportunity for value investors. TME stock, which ended at $6.43 on Dec. 13, has a “buy” rating and a $9 price target from CFRA.