Should you invest in Bitcoin?

Around 2.9 million unique users are currently using cryptocurrency. This is an adoption of 1% of the whole population. This means that there is still a lot of time before the market becomes overcrowded. And it is quickly grooming one value-wise – the prices reached $12000 not so long ago. The total value of the market is around $300 billion already.

Bitcoin’s intrinsic value?

Bitcoin is a financial instrument which is based on scientific logic. There is a protocol and mathematics which form the cryptocurrency. Anyone can review the code behind it, you are not faced with hidden fees, blocking of accounts and privacy issues. There are no working hours or certain locations.

1. Production cost

Just like precious metals, Bitcoin can be considered a commodity. To create it you have to go through the process of mining. You need a strong computer and a lot of electricity. Anyone would of course do the math beforehand and make sure they are not selling at too low of a price.

2. Scarcity

Bitcoin will never be more than 21 million and by 2140 the mining will continue. Every 10 minutes the amount of mined bitcoins decreases. Once 210K blocks the reward for one goes in half. For the record in 2009 the reward was 50 (meaning 50 bitcoins were created out of nothing and given to the miner), then in 2012 it was 25 and in 2016 only 12.5.

3. Network value

The price of bitcoin is derived from the total utility of the bitcoin network. The value is connected to the number of people who are participating in the network, the usefulness of this network and the perceived value of the cryptocurrency.

4. Medium of exchange / store of value

Many believe that this crypto will get its value from its use as a medium for exchange and as a store of value. Those two are dependent on one another. This comes from the thought that in order for something to hold value, it should have intrinsic value and if it is not used as an exchange medium it becomes worthless.

What is the right way to invest in Bitcoin?

The first thing you need to do is create a wallet. There are many types with different pros and specifications. Some of those are cold, hot, hardware, paper, mobile, desktop wallets and so on. You have to do your research beforehand in order to pick the one which will be perfect for your needs. Still, here you can read some recommendations. Firstly, you have to create a wallet with which you will be able to purchase your first crypto. Some good ones for this purpose are Coinbase, Blockchain.info, Electrum and many others. If you are just starting out we would suggest going for Coinbase.

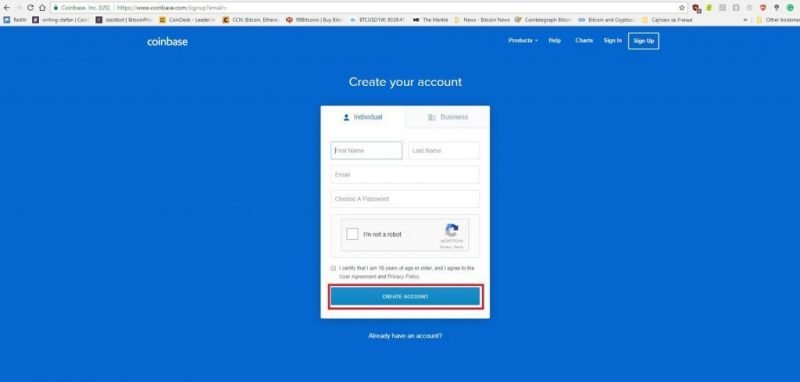

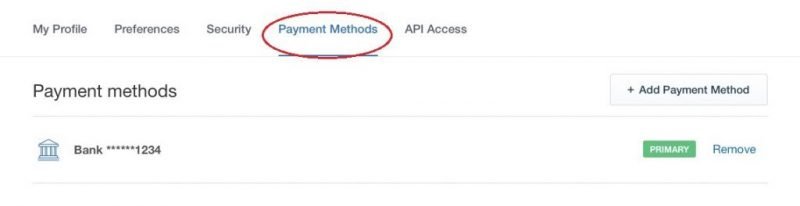

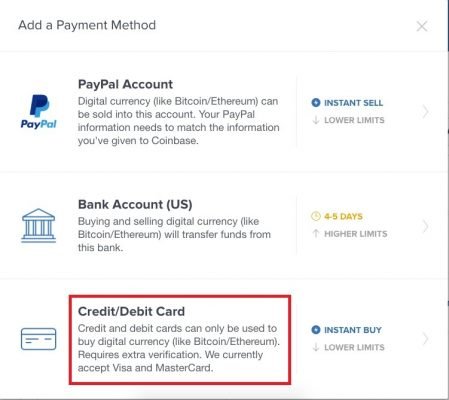

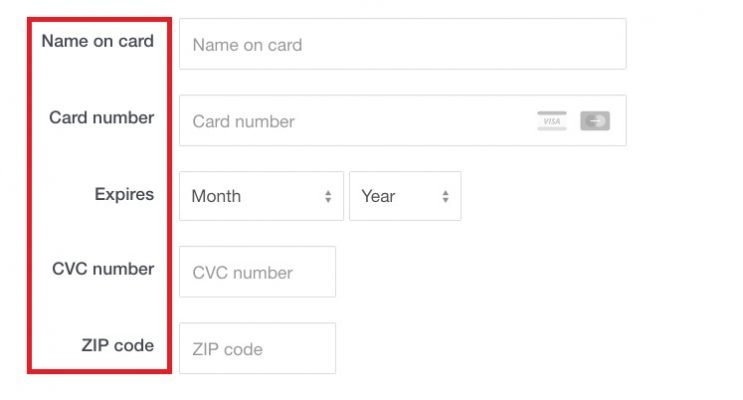

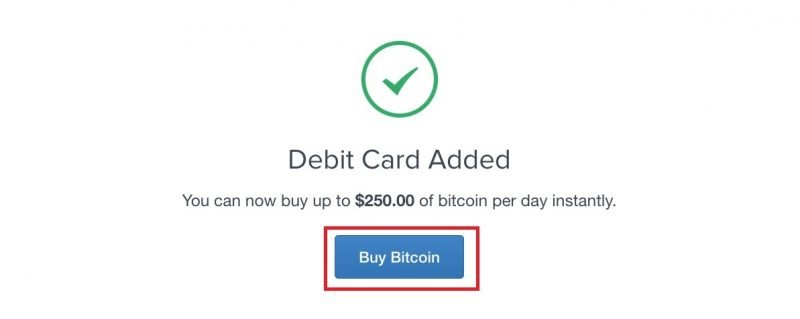

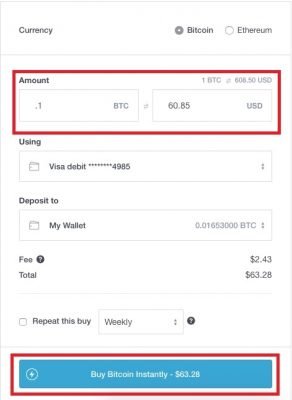

To set it up you need to visit https://www.coinbase.com/ and click on the button that says Get Started. Fill in the information, come up with a secure password, and create a profile. Once you have verified the account, you have to connect the wallet to your bank account. If you choose to use a credit/debit card it will only take a couple of minutes. You should go to settings and then Payment Methods. There you can find the credit/debit card option. Click on it and fill in the information that is needed. Next, you should click on Buy Bitcoin. Choose the amount, select your card and go to Buy Bitcoin Instantly.

Some things you should forget:

1. Be realistic

Accept that you’re just starting out, so do your research and get educated. Since you are putting your money on the line, you should understand well how the market works. This is an unpredictable industry, so make sure to always read the latest updates and keep an eye on what’s happening. You can choose a couple of big sites and visit them often, pick up some books to learn more and so on.

2. Learn from the experts

You should be cautious when educating yourself on the Internet. Not all advice is good advice, and there is no one who can predict what will happen with crypto with certainty. Pick some experts and start following and learning from them. Collect information from multiple sources before deciding on what to do by yourself.

3. Make sure that your investment is secure

You should always be careful and protect yourself from hacker attacks. You are your own bank here and if there is a breach, there is no one who could help you. In case you lose your private key or you cannot enter your wallet, it will remain locked forever.

Your password should be super solid. It should also be unique and not used before for other websites. Never share it with anyone. Two-factor authentication is also a must. You can use hard or paper wallets for extra security. Lastly, you should have a back up plan in case something happens to you. You don’t want these funds to just stay there untouched for the rest of time.

4. Be cautious for scams

There is a lot of money involved in this industry so it is normal to have a lot of scammers too. You should be careful where you invest your money. There are many offers which sound too good to be true. This is because probably they are.

5. Be careful with the risks.

You should always invest only the money you can afford to lose. Never more than that. This is every financial expert’s advice. There is high volatility and risk in this market so you should always know how and when to stop. Coming up with a strategy beforehand is a must. Decide on the desired profit margin and on the amount you can afford to lose.

6. Regulations and Taxes

Bitcoin is taxed as property by the IRS. In case you cash out before the end of the year you will have to pay much bigger taxes. Research the regulations and taxes in your country. Never do anything illegal.

Ways of selling your Bitcoins

Once you have some profit you will want to convert the crypto to fiat. You can do it in the following ways:

1. Sell them online

This is the easiest way and you can use a platform like Coinbase to do it. This is how to do it: visit the Sells page. Then write the number you would like to sell. Choose the desired wallet and then where you would like to send them. Lastly, click Sell Bitcoin and you are done.

2. Sell in person

This could be difficult depending on where you live. When you have contacted the buyer you should just scan the QR code from their phone and take the needed amount in cash from them. You can look for buyers and sellers close to you on LocalBitcoins.com. After that, you only have to meet them and make the transaction. Always be careful when doing so!