Recently, a new forecast appeared, regarding precious metals. There are many different opinions when it comes to the highest value gold will be able to reach in 2020. However, many agree that as a whole the value will be a bit above the current one. I personally believe that this precious metal will even surpass the estimated value by many analysts, which was $1,560 per ounce. This will happen because of the central banks which will have an impact as well as a result of some uncertainties in the geopolitical aspect.

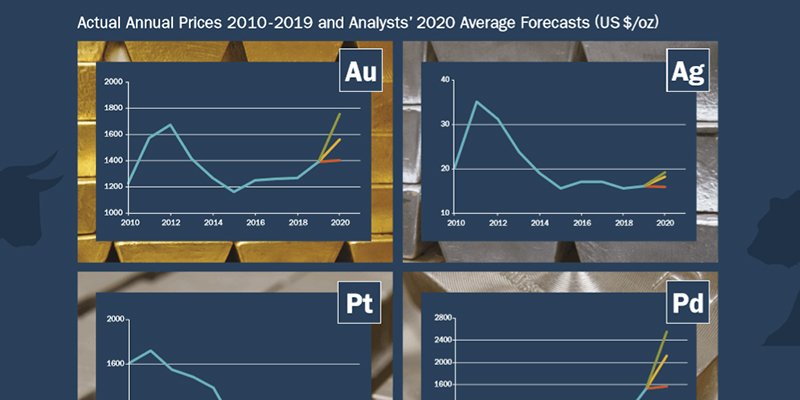

The published by LBMA forecast for 2020 includes data for gold, silver, platinum, and palladium. It states that all precious metals will experience a rise in price, but it will be a slight one from the levels registered in January.

It is said that there will be an increase of 12% for gold and silver, 16% for platinum, and 37% for palladium. Some analysts believe that there will be some fluctuations in the value of gold. One has predicted an average gold price of $1755, and another- $1398.

When you put all predictions in one, the average value appears to be $1550 for the year ahead. This is slightly different from the current average price. Analysts are cautious and stay away from less conservative predictions. The past has shown that gold usually goes a bit higher in value than the forecasted by the professionals’ amount. I believe in 2020 it will go higher than the $1550 which could be found as an average in the report by LBMA.

Some geopolitical and economic tensions, U.S. monetary policy, the upcoming U.S. elections, and Brexit are some of the reasons for fluctuations in the prices of gold that the analysts have given.

Because of the future uncertainties, I believe that gold’s “fear factor” will be present and it will make investors keep gold as a portfolio hedge. I believe 2020 will be the year when we see an ultra-high value of gold at around $1,700.

Central banks will also play an important role this year in maintaining the increasing trend in value of the precious metal. The Fed will have to keep its benchmark interest rate low. This is also because 2020 is a presidential election year. In this way the Fed would try to look non-partisan as always. So, we can bet that the fed funds rate will remain unchanged this year. This low interest rate will increase the price of gold, because it will reduce the risk of competition from bonds and non-yielding bullion.

The central bank of China has taken liquidity injection measures in order to help the financial market. Because of the Covid-19 situation the People’s Bank of China has made a statement that it will buy 1.2 trillion yuan in short-term bonds. The Chinese government is trying to prevent the withdrawal of investments and it seems to be working. An accommodative monetary policy stance should also help the gold prices in 2020.

It is known that central banks are continuing to purchase gold. The reserves of it are reaching a very high level which hasn’t been achieved in the last half a century.

With all this in mind, it is possible that the value of the precious metal will be higher than expected. Central bank monetary policy and gold purchases will keep the bull market in good shape. Because of some uncertainties investors will almost for sure decide to keep their gold. A bullish longer-term stance toward gold is still warranted.