This article will tell you more about the different approaches you could take in order to start online trading.

Property Crowdfunding

Real Estate is a great way to start since it is known for keeping its value well. You should always do your research before decking where to invest your money. It is not a bad idea to pick a couple of different regions and get an estate there. Diversifying in such a way is necessary for minimizing the risks. Some great platforms are Property Moose (UK), Housers (UK), iFunded (Germany), and Bulkestate (Estonia). Here it could be said that the annual return will be between 4 and 12%

Personal Finance (Loans)

With the recent crisis that many European countries have experienced, interest rates have fallen dramatically. People from some countries had financed for investing, and others needed cash. That led to the creation of loan platforms which are performing well these days. You can use them for diversification, choose the specific types of loans you would like to invest in like car, business, bridging loans, and many more. Some good platforms are Mintor, Peerberry, and Iban. Here the expected annual return is between 8 and 12%.

Stock Market

You can go ahead and skip on hiring a financial advisor here. They are just collecting your money for managing your funds. You can replace them with a robot-advisor like the one at Finizens.

You could also choose to invest in dividend growth. A lot of information is available online, uploaded by investors who are writing in detail about their monthly earnings. Some of the benefits here are that there are no annual commissions, which saves you money, you can pick the companies in your portfolio, and it brings more excitement since you can choose and monitor your preferred company. One website to follow is Dividend Growth Investor. Annual return: over 10%

Trading with precious metals

Starting off, you should be aware of what bullion is. It’s bars, ingots or coins made from almost 100% pure gold or silver. If you would like to skip on worrying about storing those assets, you should check out the BullionVault platform. They take care of that, and you can buy and sell using the site. You should research the differences between owning gold and stock, for example. Precious metals are great for a long-term strategy, and they perform better than bonds and stocks. Some people actually consider silver and gold more of a hedge, securing their wealth. Although some of the other already mentioned areas should be a priority, it is still not a bad idea to put some of your money in precious metals. Annual return cannot be calculated. It’s more of a hedging tool.

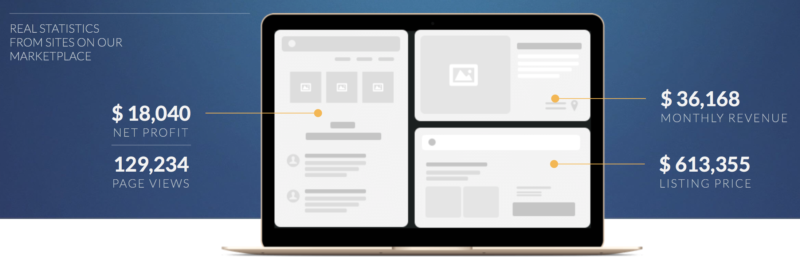

Online Properties

Here we are referring to mobile applications and websites. You would purchase an already existing one and work on it to make it successful. The annual returns to go as high as 40%. You should stay away from Amazon affiliate sites because that would not be able to make good money, and you won’t be your own boss. Some good platforms are OnFolio and Domain Magnate, and an interesting podcast is Empire Flippers. Do your research about the different niches and pick the one you think is best for you. Some I like are tech, personal finance, and online marketing. You could expect an annual return of over 40%

Cryptocurrencies

This might be the only way to ensure you get a quick result – you will either win a lot or lose a lot in no time. It’s a fascinating way to invest your finances, and you should definitely read more and get informed. The risk is bigger, but the rewards are also heftier. You shouldn’t go under 20% annual return with a flat market, and as a whole, you could go over 100%.

Foreign Exchange

This sphere offers a lot of opportunities, but you really have to know what you are doing. Otherwise, your chances of success are slim. You will have to spend time every day carefully analyzing and watching the charts. This is the only way to end up with a profit. You could expect an annual return between 30 and 40%.