Growing up and being a teen are the best times in life, but remember that independence comes with challenges and endless costs. Paying for college yourself can be a nightmare.

Because most banks primarily lend to paid professionals, students are sometimes at a loss for solutions to their money problems. Don’t worry, because we’ve rounded up several fantastic mobile apps and internet platforms that not only make loans easy and immediate. provide liberal return policies with nearly no interest.

Thus, to all our future heroes and entrepreneurs who are slowly making their way down the crooked path to independence, we give you the life-saving apps you must always have on your phone.

1. mPokket

mPokket is one of the easiest and most widely used loan options for college students, allowing them to borrow amounts ranging from 500 INR to 20,000 INR. All you have to do is download the app, upload copies of your student ID and Aadhaar card, and voila! You are now ready to depart.

Money from mPokket may be deposited immediately into your bank account or Paytm wallet and must be repayed within one to three months at a rate of 3.5 percent or higher (varies). Indeed, this is a win-win situation!

Note: Only full-time students aged 18 or older enrolled in a recognized university and possessing a bank account can apply for a loan. This deal is not available to correspondence students.

2. Pocketly

Offering convenient cash “anytime, anyplace” is the next entry on our list, dubbed “mPokket.” The app is a market leader in delivering instant loans to Indian students, who may use it to fund necessities such as tuition, recreational activities, and personal costs.

The Pocketly app is on Google Play, and with a single click, you can apply for quick money loans that may be returned in easy installments with no minimum value requirement. Credit payback terms range from almost one to three months and are given at a monthly interest rate of around one to three percent.

3. RedCarpet

Students may use RedCarpet to obtain immediate loans for various online and offline transactions. The app offers an interest-free, hassle-free one-month repayment period on loans ranging from 1,000 to 6,000 INR. Additionally, those opting for EMI alternatives have the choice of repaying the balance over a three, six, nine, or twelve-month period.

The software has an embedded tracker to protect its users’ safety and security at all times. Additionally, it provides a Platinum Mastercard that may be used for various purposes, including online purchases, ATM cash withdrawals, and point-of-sale transactions.

4. KrazyBee

KrazyBee is another popular addition to our list and is an excellent source of quick cash for college students. You may apply for cheap credit loans with just your student ID card and proof of address to cover semester fees, educational expenditures, internet shopping, and even a two-wheeler.

The loan to KrazyBee can be repaid in 12 months via simple EMIs.

Note: Students aged 18 or older who are enrolled in a degree or diploma program at one of the recognized universities are eligible for the loans.

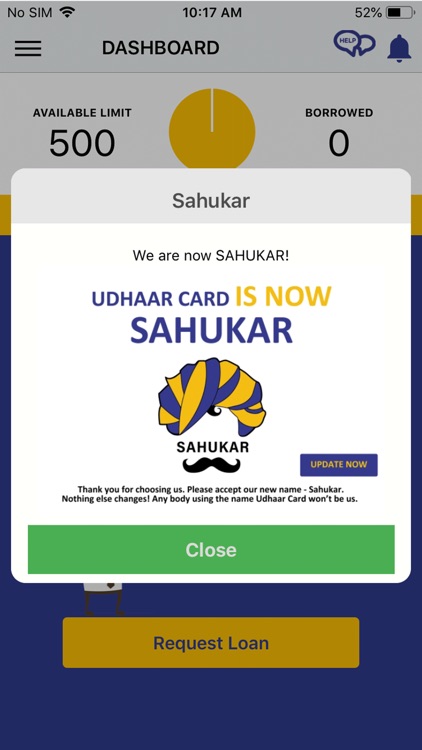

5. Sahukar

Sahukar is an easy-to-use online rapid lending platform that helps students to borrow between INR 500 and INR 5,000. Borrowed funds may be repaid in 90 days at a monthly interest of 3%. All you need to do is download the Sahukar app, register, and apply for the loan amount corresponding to your credit score.

The funds are immediately sent to your bank account or Paytm wallet. The app features electronic loan approvals without the need for physical documents, like a tempting referral bonus in the form of cash or discounts.